How to Calculate Customer Acquisition Cost: A Practical Guide for Marketers

Learn how to calculate customer acquisition cost with step-by-step examples, channel segmentation, benchmarks, tracking setups, and tactics to lower CAC for ads and AI-driven funnels.

Jan 19, 2026

Every growth plan hinges on one question: what does it cost to win a customer and is that cost sustainable? Understanding how to calculate customer acquisition cost is essential if you run paid ads, manage social channels, deploy AI chat agents, or lead a sales team. This guide walks through the math, common pitfalls, channel-level segmentation, tracking setups, and practical ways to cut CAC without sacrificing growth.

What is customer acquisition cost and why it matters

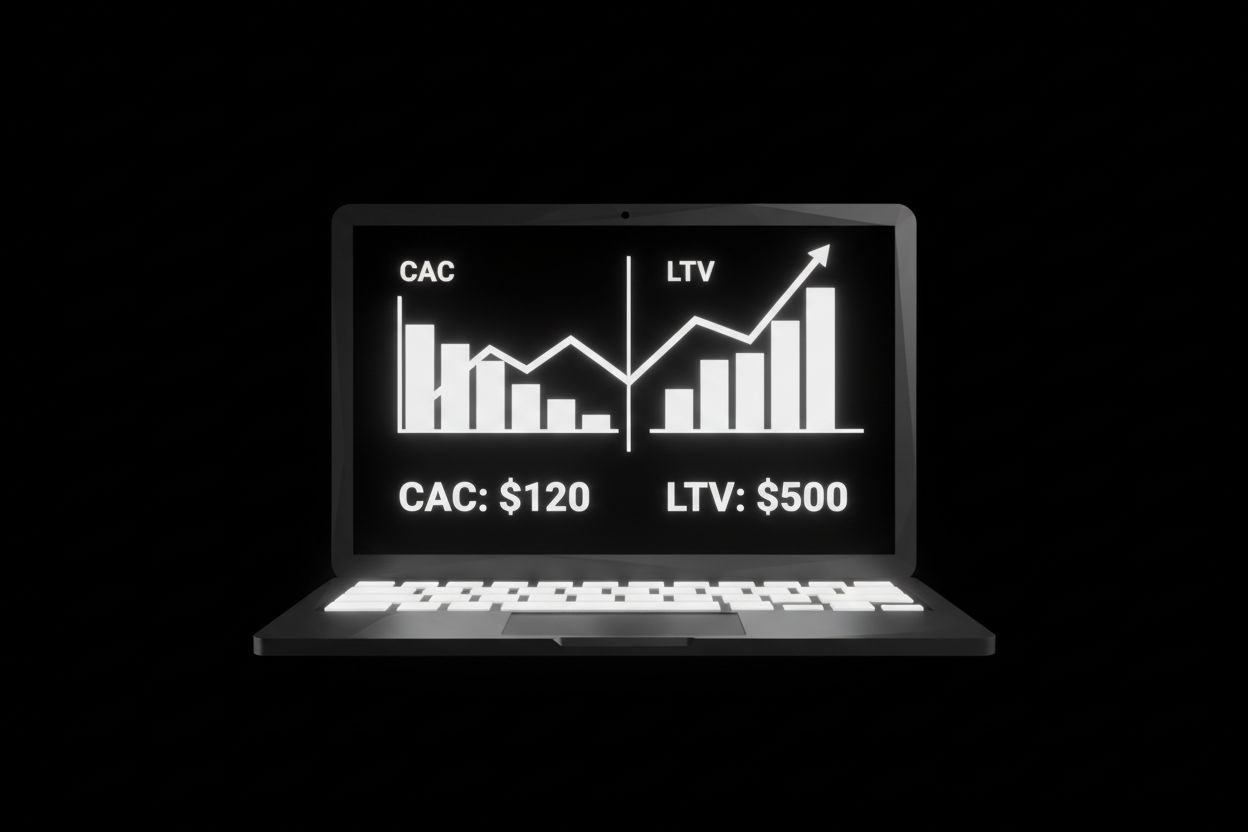

Customer acquisition cost, or CAC, is the average amount your business spends to acquire a single paying customer over a chosen time period. It is a north star metric for growth teams because it ties marketing and sales investment directly to new revenue.

Why CAC matters

It validates whether your growth engine can scale profitably.

It tells finance and leadership how long before a new customer becomes profitable when combined with lifetime value.

It helps you allocate budget across channels such as Meta, TikTok, paid search, social, referral, and email.

Use CAC alongside LTV, churn, and payback period to decide where to invest and when to tighten spend.

The CAC formula and what to include

The basic formula is simple:

CAC = Total Sales and Marketing Costs ÷ Number of New Customers Acquired

Breakdown of components to include

Salaries: marketing, sales, and allocation of leadership time related to acquisition.

Paid media: ad spend on Meta, TikTok, Google, programmatic, affiliates.

Creative and production: agency fees, video production, copywriting.

Tools and software: CRM, analytics, ad optimization, email platforms.

Campaign-specific direct costs: promotions, influencer fees, rebates.

Overhead allocation: a conservative share of rent and general ops tied to the commercial function.

What not to include

Costs tied purely to product support or retention like customer success activities focused on existing customers.

Depreciation of core product R&D that does not influence acquisition.

Tip: Pick a single period to measure, for example a calendar quarter. Make sure costs and customers belong to the same period or use a rolling 3-month window.

Step-by-step CAC calculation with examples

Step 1: Decide the time period. Use monthly, quarterly, or yearly windows.

Step 2: Sum acquisition-related costs for that period. Example for Q1:

Marketing salaries and commissions: $40,000

Ad spend (Meta and TikTok): $60,000

Creative and agency: $15,000

Tools and software: $5,000

Promo discounts tied to acquisition: $2,000

Total acquisition cost = $122,000

Step 3: Count the number of new paying customers acquired in Q1.

New customers = 1,220

Step 4: Apply the formula.

CAC = $122,000 ÷ 1,220 = $100

Interpretation

If your average customer lifetime value is $300, your LTV:CAC ratio is 3:1 which is healthy for many businesses. If LTV is only $150 the 1.5:1 ratio signals unprofitable growth.

Multiple scenarios

Blended CAC uses all channels combined.

Channel CAC isolates spend and customers by channel, for example Meta CAC or TikTok CAC.

New CAC measures only customers who made their first purchase during the period, excluding reactivations.

Segmented CAC: channels, personas, and products

One size does not fit all. Segmenting CAC gives actionable insight on where to allocate spend.

Calculate CAC by:

Channel: Meta, TikTok, Google, organic search, referrals, affiliates.

Persona: SMB, enterprise, first-time buyer, power user.

Product line: core product A, premium product B, add-on services.

How to compute channel CAC

Assign ad spend and direct campaign costs to the channel.

Attribute new customers to channels using first-touch, last-touch, or data-driven attribution depending on your setup.

CAC_channel = Spend_channel ÷ New_customers_channel

Example quick table

Meta: $45,000 spend, 450 customers, CAC = $100

TikTok: $15,000 spend, 200 customers, CAC = $75

Organic + referral: $2,000 spend, 300 customers, CAC = $6.67

Channel-level CAC reveals where you get volume and where you get efficiency. Lower CAC on organic and referral suggests investment in content, SEO, and referral programs can scale efficiently.

Industry benchmarks and acceptable ranges

Benchmarks vary widely by business model and industry. Use these rough ranges as starting points, then build your own history.

B2C ecommerce: $10 to $100 depending on average order value and niche.

B2B SaaS self-serve: $50 to $500 depending on plan and onboarding cost.

B2B SaaS enterprise: $1,000 to $25,000 depending on sales cycles and implementation.

Consumer apps: $1 to $50 for low-ticket impulse products, higher for subscriptions.

When a higher CAC is acceptable

Market expansion or new product launches where early customers are strategic.

Enterprise deals where CAC is high but contract value and lifetime are also very high.

Paid experiments to validate product-market fit.

Always compare CAC to LTV and growth stage metrics. Seed-stage companies may accept high CAC to test channels. Scale-stage companies usually target predictable, lower CAC.

Common mistakes to avoid when calculating CAC

Misaligned time windows: counting spend in one month and customers in another skews the metric.

Wrong attribution: relying only on last-click often understates upper-funnel channel value.

Over-including costs: adding retention-only expenses inflates CAC and hides true acquisition efficiency.

Ignoring refunds and churn: CAC must be interpreted with net new revenue after returns.

Using only blended CAC: misses high-performing niches or channels that could scale.

Checklist to avoid errors

Reconcile finance and marketing numbers monthly.

Use UTM and CRM to attribute leads accurately.

Create channel-level rules for where to allocate shared costs like agency fees.

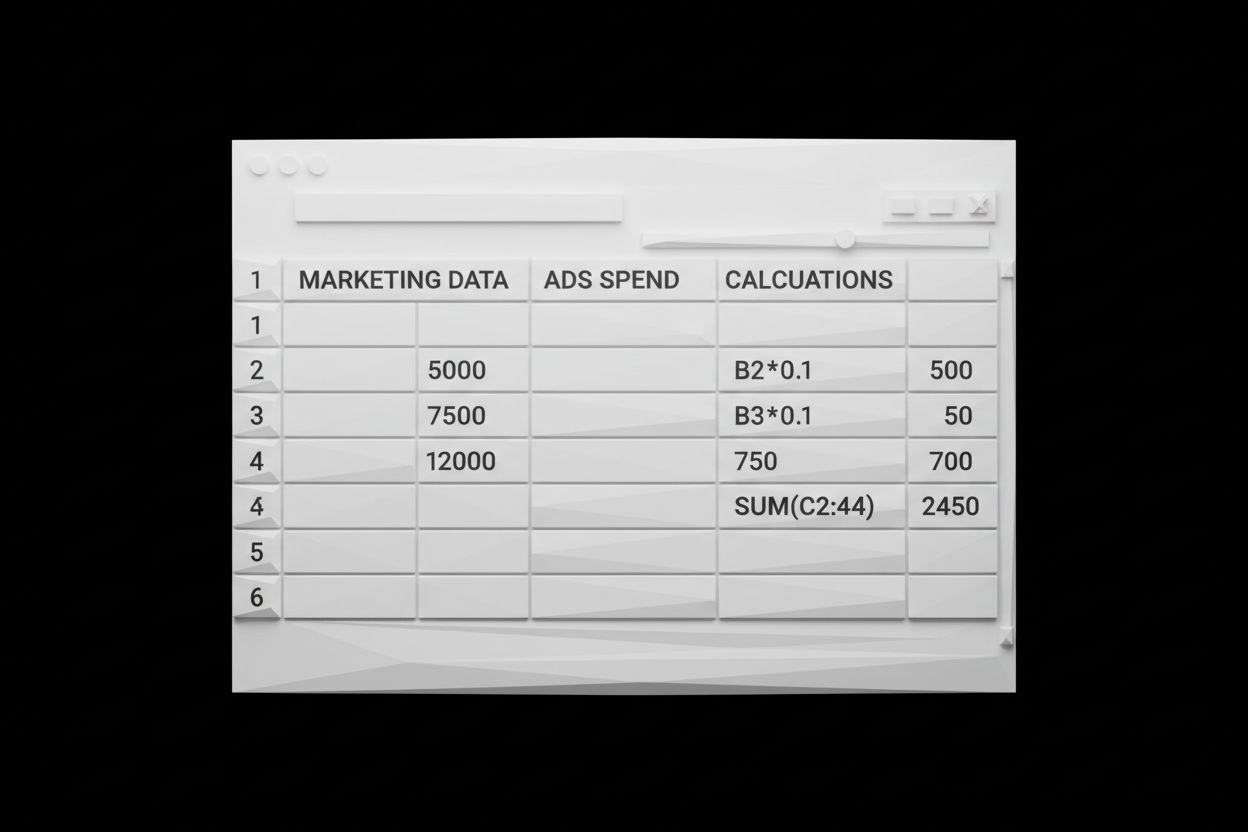

How to track CAC: tools, dashboards, and automation

Best-practice tracking setup

Single source of truth: use your CRM or analytics as canonical customer count and conversion source. Connect leads in CRM to closed deals and revenue.

Attribution: implement UTM parameters on campaigns, server-side tracking where needed, and conversion APIs for platforms like Meta.

Automation: feed ad spend and conversion data into a BI tool or dashboard that refreshes daily.

Reconciliation: match ad platforms, finance systems, and CRM monthly to close gaps.

Tools to consider

Google Analytics 4 for web behavior and goal measurement.

CRM systems to record customers and deal revenue.

BI tools or spreadsheets for custom CAC dashboards.

Conversion API and pixel setups for Meta and TikTok for reliable attribution.

Dashboard metrics to include

Blended CAC and channel CAC.

LTV and LTV:CAC ratio.

Payback period in months.

CAC by cohort and persona.

Trend lines and seasonality overlays.

If you need help setting up automated CAC reporting, consider connecting your ad accounts to a managed service like Paid Ads Management - The Social Search to reduce manual reconciliation and improve attribution.

How to reduce CAC: practical tactics for ads, social, AI, and retention

Lowering CAC requires both efficiency and effectiveness. Below are proven levers you can pull.

Paid ads optimization

Improve creative testing velocity to find top-performing ads faster.

Shift budget toward channels with lower CAC like TikTok or organic when ROI supports it.

Use lookalike and value-based audiences to scale profitable segments.

Implement conversion tracking and server-side events for Meta to reduce lost conversions.

Social and content

Invest in short-form content that drives organic discovery and lowers reliance on paid reach.

Use community and referral programs to amplify word of mouth and reduce paid dependence.

Combine social ads with high-converting landing pages and clear CTAs to increase conversion rate.

AI chat agents and lead qualification

Deploy AI chat agents to qualify leads instantly, book demos, and reduce drop-off in the funnel.

Use automation to route high-intent leads to sales quickly and warm lower intent automatically.

Learn more about implementing conversational automation from Automated AI Chat Agents - The Social Search.

Conversion rate optimization and onboarding

Reduce friction on checkout and sign-up flows to improve conversion rate and lower CAC.

Build high-quality onboarding that increases early retention and LTV.

Retention and LTV improvements

A small increase in retention or average order value can dramatically improve LTV:CAC and make higher CAC acceptable.

Upsells, cross-sells, and subscription options increase revenue per customer with minimal incremental acquisition cost.

Lead generation systems

Combine paid ads with automated nurture sequences and lead magnets to convert leads to customers more cheaply.

For systematic lead generation read the guide at Lead Generation and Marketing Automation Guide for 2026 Success - The Social Search.

If you want to automate social posting and content-to-conversion workflows to lower CAC on organic channels, see Automated Social Media - The Social Search.

For turnkey lead capture funnels that reduce manual work consider Automated Lead Generation - The Social Search.

CAC health scorecard and next steps

Use this quick assessment to judge whether your CAC is in a healthy range.

LTV:CAC ratio above 3:1 Good

Payback period under 12 months Good for SaaS

Channel CAC distribution: top 2 channels deliver 60 to 80 percent of new customers

Cohort CAC rising month over month Warning sign

Action plan for the next 90 days

Reconcile last quarter spend and compute blended and channel CAC.

Build a dashboard with LTV, CAC, and payback period updated weekly.

Run creative and landing page tests on your top two paid channels to improve conversion rate.

Deploy or optimize AI chat flows to reduce lead drop-off and increase qualification.

Revisit offers and pricing to increase first purchase AOV and early retention.

FAQ

How is CAC different from CPA and CPL?

CPA, or cost per acquisition, usually refers to a specific action such as a sale, app install, or signup and is often measured at the campaign level. CPL is cost per lead. CAC is broader. It aggregates all acquisition spend divided by new paying customers.

Should I include sales commissions in CAC?

Yes. If commissions are paid to acquire new customers, include them. Commissions align with sales cost and matter for profitability.

How often should I recalculate CAC?

Recalculate monthly for trend monitoring and quarterly for strategy decisions. Use a rolling 3-month average to smooth seasonality.

Can CAC be negative after accounting for discounts and refunds?

CAC cannot be negative. Refunds and chargebacks reduce net revenue and affect LTV but do not make acquisition cost negative. Adjust your profitability analysis accordingly.

Final thoughts and next steps

Learning how to calculate customer acquisition cost accurately is a foundational skill for anyone managing growth. Move from blended numbers to segmented CAC and pair the metric with LTV and payback period to make smarter budget decisions. If you want help implementing tracking, automating lead flows, or optimizing paid campaigns, our services can accelerate the work and reduce guesswork. Contact us to assess your CAC, build dashboards, or run experiments that improve efficiency and scale. For immediate help with automating the funnel and ad management, explore Paid Ads Management - The Social Search and Automated Lead Generation - The Social Search.

If you need a custom CAC calculator or a template to start measuring quickly, reach out through our contact page and we will share a ready-to-use spreadsheet and dashboard plan: Contact

Key takeaway: measure deliberately, segment wisely, and optimize across creative, channel, and onboarding levers to lower CAC and accelerate profitable growth.